The Consequences of Defaulting on an Unsecured Business Loan: 5 Legal Strategies Small Business Owners Often Ignore

Entrepreneurs face enormous challenges, and defaulting on an unsecured business loan can feel like a financial death sentence. Shockingly, more than half of business proprietors who default on unsecured loans risk bankruptcy within one and a half years. Yet, most remain unaware of five legal strategies that could preserve their fiscal well-being. This comprehensive guide discloses what really happens when you default on an unsecured business loan and outlines the effective steps you can take to evade complete financial ruin.

What Happens When You Default?

In contrast to secured loans, where lenders can swiftly seize collateral like property or equipment, unsecured business loans create a distinct set of obstacles upon default. Here’s how it unfolds:

Delinquency Phase: Upon skipping a payment, typically after one month, your loan enters delinquency. Lenders may charge late fees and report credit bureaus, signaling the first stage of trouble.

Default Declaration: After a quarter-year of missed payments, most lenders declare a default. This triggers a cascade of repercussions that can endanger your business.

A primary effect is the severe hit to your credit score. Anticipate a decline of 100+ points almost instantly. Imagine your business credit like a delicate structure—one missed payment can cause the entire thing to crumble. This impairment can remain on your credit report for as long as seven years, making new loans nearly impossible or unaffordably pricey.

What Lenders Can Do

Without collateral to seize, lenders pursue other paths to recover their funds. Here’s what you might face:

Collections: Lenders may assign your debt to collection agencies, who will aggressively contact you via phone, email, or mail.

Lawsuits: If collections fail, lenders can sue to obtain a court judgment. This could permit them to attach your business bank accounts, place liens on business assets, or even force liquidation. Imagine walking into your business to find critical machinery being repossessed or your accounts inaccessible out of the blue.

Personal Guarantees: If a personal guarantee is in place, the stakes are significantly greater. Roughly 86% of business financing include personal guarantees, however numerous entrepreneurs don’t fully understand the implications until it’s too late. Your residence, vehicles, personal bank accounts, and even future wages could be in jeopardy.

Five Lawful Solutions

Although failing to repay an unsecured loan feels overwhelming, there are five legitimate approaches to mitigate the damage and safeguard your financial future. Let’s explore each one:

1. Proactive Communication with Lenders

Early dialogue with your lender is key. Contacting your lender at the initial indication of difficulty can open doors for modified payment plans. About two-thirds of financiers prefer renegotiating loans over dealing with defaults. Consider requesting interest-only payments, longer repayment periods, or a temporary payment pause. Take the case of a Chicago-based eatery owner who effectively secured a half-year interest-only plan during off-peak winter season, enabling them to recover when business picked up.

2. Settle the Debt

Numerous creditors more info will accept a single payment of 40-60% of the outstanding balance rather than pursue full repayment through pricey legal channels. Showing financial hardship while offering quick cash can persuade lenders to settle. An innovative tech company negotiated a 45% debt reduction by providing evidence of their economic difficulties and presenting the reduced amount upfront.

3. Challenge the Loan Terms

Occasionally, you can formally contest the debt if there were predatory practices, breaches of agreement, or miscalculations. Approximately one in seven business loan defaults involve contested conditions. Keep detailed records and consider consulting a business attorney who specializes in debt matters.

4. Bankruptcy Protection

Filing for bankruptcy under Chapter 7 asset liquidation or Chapter 11 reorganization can provide temporary relief, but it comes with severe lasting impacts for your company functionality and personal financial standing. View bankruptcy as a last-ditch effort, not a initial strategy.

5. Renegotiate Personal Guarantees

If a personal guarantee is in place, you may be able to renegotiate the terms to reduce your personal liability. Engaging a legal professional can help you explore options to safeguard your personal assets.

Essential Points

Missing payments on an unsecured loan can trigger a series of consequences that endanger your company and personal finances. Nevertheless, by acting proactively, you can leverage lawful solutions to reduce the damage. Reach out promptly, consider settlements, dispute unfair terms, and thoroughly evaluate bankruptcy as a ultimate measure.

To dive deeper, watch our next resource on how business financing options affect your personal credit score, including three key elements most lenders keep hidden that could save your credit while building your company.

Tatyana Ali Then & Now!

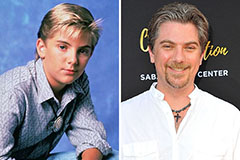

Tatyana Ali Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!